Financing infrastructure connectivity for transport and economic development in Asia

- Like

- Digg

- Del

- Tumblr

- VKontakte

- Buffer

- Love This

- Odnoklassniki

- Meneame

- Blogger

- Amazon

- Yahoo Mail

- Gmail

- AOL

- Newsvine

- HackerNews

- Evernote

- MySpace

- Mail.ru

- Viadeo

- Line

- Comments

- Yummly

- SMS

- Viber

- Telegram

- Subscribe

- Skype

- Facebook Messenger

- Kakao

- LiveJournal

- Yammer

- Edgar

- Fintel

- Mix

- Instapaper

- Copy Link

Posted: 11 June 2018 | Dr Jang Ping Thia - AIIB | No comments yet

Dr. Jang Ping Thia, Principal Economist in the Strategy, Policy and Budget Department of the Asian Infrastructure Investment Bank (AIIB), details the large infrastructure requirement within Asia and explains AIIB’s objectives, priorities and approaches – focused on completing the vision of a more connected Asia, for both trade and development.

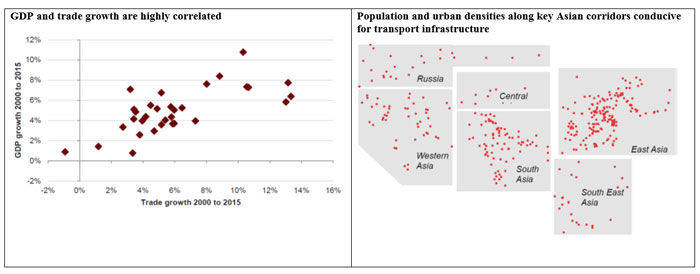

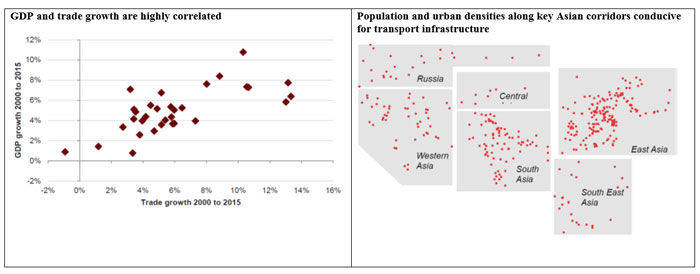

With global trade wars and rising protectionist sentiments, the words of Joseph Stiglitz resonate: “In developing countries, lack of infrastructure is a far more serious barrier to trade than tariffs.” In one sentence, Stiglitz has accurately summarised the present issue in Asia.

Take for example, Malaysia, with a per capita gross domestic product (GDP) of $9,500 and Bangladesh with a GDP of $1,360. Though both have access to open water, it costs approximately $500 to export a container of goods from Malaysia, but $1,300 from Bangladesh. If one assumes that the basket of goods exported by Bangladesh is averagely lower in value than Malaysia’s, the shipping cost (as a percentage of export value) would be even higher for Bangladesh. Such ‘trade barriers’ are highly regressive and fall hardest on the poorest regions.

This example highlights two important points. Primarily, Asia is not particularly poor in transport infrastructure provisions. In fact, some Asian countries have achieved world-class transport systems. Secondly, world-class transport infrastructure is not a privilege or characteristic specific to high-income countries. Malaysia’s port infrastructure ranks 20th in the world, according to the World Economic Forum. This is at par with many developed economies and far above Malaysia’s ranking in per capita GDP.

However, the reality in Asia is that infrastructure provision varies greatly from country to country, region to region. On one hand, East Asian economies are part of a highly integrated supply chain, with a high level of production sharing, as seen by the levels of intraregional trade in intermediate goods. On the other hand, there are regions that are still lacking in basic infrastructure provisions.

It is against this that AIIB developed its Transport Strategy1, which will be discussed at our Annual Meeting2 on 25-26 June in Mumbai. Our transport and connectivity workshops – which gather experts from the European Bank for Reconstruction and Development, AIIB and various governmental transport-focused bodies across the world – will discuss the need for regional infrastructure integration and explore how Asia can take advantage of technological advances to improve connectivity.

The challenges

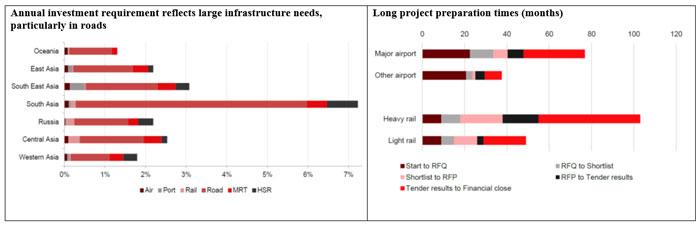

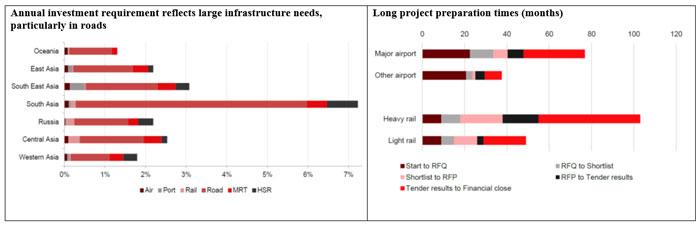

There are three key characteristics of the transport infrastructure sector. First, the demand in Asia remains very large (estimated at more than $500 billion per year). In absolute terms, it is dominated by the road subsector, but others, such as air and rail infrastructure need to be developed quickly to cope with rising demand. Second, the project preparation and construction cycle is very long. Transport infrastructures are networked by nature, which implies a certain level of complexity. Proper planning and integration would be required for the investment to be effective. Transport projects often have large environmental and social impacts that need to be adequately addressed. Third, transport infrastructure projects often face competition and uncertain demand conditions. Unlike utilities, transport projects face modal competition and will have to contend with economic cycles. Compared to other infrastructure sectors, the incidence of white elephants is probably the highest in the transport sector.

Credit: AECOM

Which areas will be impacted?

There are many areas where investments can have a high impact and here, three are discussed in detail.

The first area is rail infrastructure, including urban rail. China’s experience has shown that high-speed rail can be economically viable even at around $6,000-$7,000 per capita GDP, under the right conditions. Some Asian economies do have similar conditions – large populations along densely populated corridors, high growth and rapid urbanisation – that can potentially sustain such a rail. Even if high-speed rail is not feasible, other rail investments and upgrades (including electrification, double-tracking and higher speeds) would be required. Generally, with electrification, the carbon emission per kilometre over short-to-medium distances would be lower than air transport. Related to this is urban or suburban rail development to support successful urbanisation. Rail lines that connect city centres to ports or airports, integrated with urban metros, can have a positive developmental impact. The recently completed Jakarta airport rail connects the main international airport to the city centre, reducing travel times to one hour. Hanoi, a city of 8 million, has recently welcomed its first urban metro line.

The second area is airports. In the next two decades, China’s air passengers will grow from around 500 million per year to more than a billion. Over the same time frame, India will see a very high growth in air traffic, reaching almost half a billion air passengers per year. The challenges here are two-fold. There is a need to invest in more airport infrastructure to meet some of the demand. There is also a need to manage the carbon footprint by shifting some of the demand for short-to-medium distances to rail and using more sustainable fuels in aviation.

The third area is ports and their access, as 70 per cent of world trade will still be transported by sea. Overall, Asia seems to have done relatively better in terms of port infrastructure. The challenge here is to invest in more port infrastructure to underserved regions in Asia and provide overland connectivity (rail and roads) for landlocked countries to access major ports. It costs more than $5,000 to export a container of goods from some landlocked central Asian economies. Yet ‘landlocked’ does not have to mean locked out of trade and development. The best examples are the Czech Republic and Slovakia, where it costs $1,200 and $1,500 respectively to export a container– higher than neighbouring countries with sea access, but not punitively so.

How can AIIB help?

Our Transport Strategy positions AIIB to be a financier of choice to both governments and private sector sponsors, in order to promote trade and economic development through investment in infrastructure. AIIB will prioritise projects that have a large economic development impact, even if financial returns are lower. We will consider the long-term economic returns of projects, including spill-over effects to other developmental aspects. In terms of project types, these would likely be trunk infrastructure – e.g., key roads, airports, ports or even passive information and communications technology – that support a wider cluster of activities. Projects with cross-border benefits would be doubly welcomed. AIIB is flexible in its financing approach. We can fund the government’s share of such a project through a sovereign-backed loan, private sector’s share through loans or equity investment or even provide contingent financing. While we demand high standards in terms of environmental and social safeguards, as well as governance, we will focus on what the project brings in terms of economic benefits and not expect the project to fulfil objectives that are otherwise incidental.

AIIB is prepared to play a strong role in crowding private capital to help meet the large demand. We are prepared to consider investing in platforms (e.g., funds and investment trusts) that will allow our initial capital to mobilise other private investors. In fact, we are prepared to refinance secondary assets, if it can be demonstrated to AIIB that such asset recycling will lead to more capital deployed for infrastructure development. In the context of the transport sector, this means that AIIB will be able to provide (re)finance to operating assets such as toll roads, ports or airports.

Our 2018 annual meeting is focused on ‘Mobilizing Finance for Infrastructure: Innovation and Collaboration’ and transport projects will be a major element of the discussion.

As mentioned earlier, transport projects are often complex and would require a long preparation period. We are prepared to engage early (with both governments which are our shareholders and the private sector) in the project preparation cycle. We are prepared to work with a range of partners to provide the supportive conditions to ensure successful projects.

AIIB will promote environmental and social sustainability through its investments. Asia’s transport emission will have to be reduced through a combination of ‘avoid, shift and switch’ approaches. Avoiding excessive traffic requires better land use planning. Shifting involves substitution of a transport mode to a lower-carbon mode, such as aviation to rail for short-to-medium distances. Switching pertains to a change of transport energy source from high carbon to low carbon. The confluence of technology and infrastructure, together with digitisation, data analytics and behavioural insights, underpins the exciting agenda on smart cites and smart infrastructure. Greener and more efficient transport systems can be made possible through technology. Through our financing, we hope to deploy any such innovative and green technology across Asia.

Finally, AIIB will look to provide financing to projects that can enhance connectivity with Asia, even if the projects are outside of Asia.

References

- https://www.aiib.org/en/policies-strategies/strategies/transport.html

- https://www.aiib.org/en/news-events/events/annual-meeting/overview/index.html

Biography

Related topics

Fleet Management & Maintenance, Infrastructure & Urban Planning, Transport Governance & Policy

Related cities

Asia

Related organisations

AIIB

Related people

Jang Ping Thia