Benchmarking of urban rail systems

- Like

- Digg

- Del

- Tumblr

- VKontakte

- Buffer

- Love This

- Odnoklassniki

- Meneame

- Blogger

- Amazon

- Yahoo Mail

- Gmail

- AOL

- Newsvine

- HackerNews

- Evernote

- MySpace

- Mail.ru

- Viadeo

- Line

- Comments

- Yummly

- SMS

- Viber

- Telegram

- Subscribe

- Skype

- Facebook Messenger

- Kakao

- LiveJournal

- Yammer

- Edgar

- Fintel

- Mix

- Instapaper

- Copy Link

Posted: 1 April 2005 | Knut Petersen, Managing Partner, BSL Management Consultants; Oliver Drümmer, Principal, BSL Management Consultants and Tilmann Colberg, Consultant, BSL Management Consultants | No comments yet

The powerful management tool of benchmarking helps uncover possibilities of optimisation for public transport companies by using the following criteria:

The powerful management tool of benchmarking helps uncover possibilities of optimisation for public transport companies by using the following criteria:

The powerful management tool of benchmarking helps uncover possibilities of optimisation for public transport companies by using the following criteria:

- The global context

- Basics and methodology of benchmarking

- A specific benchmarking example

- From benchmark to action

- Bottom line

The global context

Public transport companies in Europe are facing a considerable change in the economic, legal and political circumstances they are embedded in nowadays. In order to face these new challenges, benchmarking has evolved into an intensely used management tool in the domain of public transportation. Also for the evaluation of the costs of a ‘typical, well-run undertaking’ in the sense of the last of the four criteria, which the European Court of Justice established in the judgement of the case ‘Altmark Trans’, the tool of benchmarking is likely to play a major role.

The method at hand does not only serve for optimisation of single aspects but encompasses all company functions in an integrated way. A qualified benchmarking leads to a comprehensive assessment of the company. From our experience, this often constitutes the basis for the elaboration of region and company-specific global strategies which are socially balanced and accepted by all stakeholders. This is a prerequisite for a more or less smooth implementation of the resultant concepts for modifications and improvements.

Before going into the details of the benchmarking methodology, it should be pointed out that benchmarking offers many opportunities, but it also has its limitations. It offers quantitative performance indicators in many areas, provides targets and asks pointed, inconvenient questions to the management and personnel. It can provide a long-term orientation but no prefabricated specific solutions. The adequate way to achieve the established goals and the culture to be implemented are generally elaborated in a second step by detailed process analysis.

Basics and methodology of benchmarking

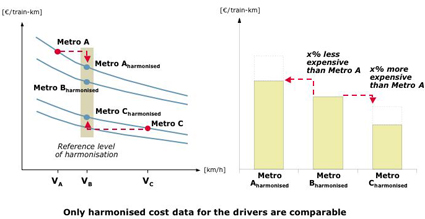

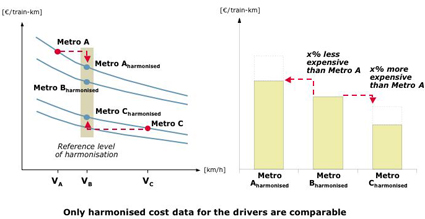

The structural circumstances of the public transport companies that are not changeable by short and middle-term management can turn out very diverse. Therefore, the art of benchmarking is to create comparability without blurring the critical performance differences. The goal of making the data comparable is achieved by the so-called ‘harmonisation’ of those specific structural parameters which are not changeable by the company. Performance differences controllable by management are not harmonised and thus revealed by the benchmarking, leading to meaningful, utilisable and hence valuable results.

This is one of the essential motivations for public transport companies to take part in projects referred to as ‘benchmarking circles’, in which the participating companies set themselves the target of learning from each other and exchanging ideas and process approaches across national borders. The framework for these benchmarking circles is an open and confidential cooperation, conducted by BSL Management Consultants who account for the appropriate and consistent data analysis within the study.

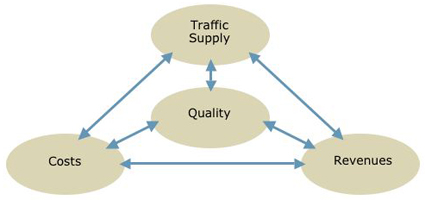

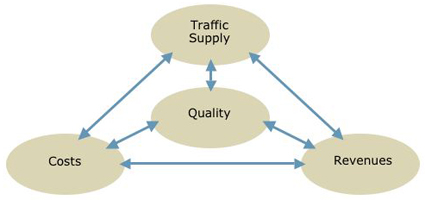

Unlike other approaches, the benchmarking methodology presented here places emphasis on an integrated perception of the public transport system, extending the conventional cost benchmarking by an analysis of the traffic supply aspects, the revenues situation and the quality performance (Figure 1).

This comprehensive view on the overall performance of the respective company allows a holistic assessment, taking into account the interdependency between the different topics and delivering important means of controlling to the management.

The usage of valid data is crucial for a solid benchmarking. This is assured by several aspects. First of all, only primary and internal data from the public transport companies themselves are used for the study, no second-hand information enters the analysis. Furthermore, intensive data validation is carried out in collaboration with the companies’ data experts on-site, including various data adjustments, before the required consistency of all data is achieved.

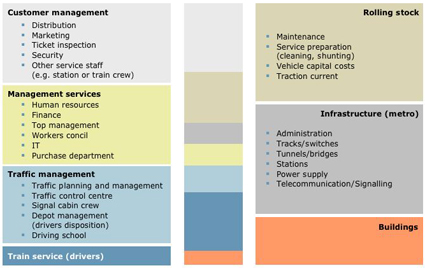

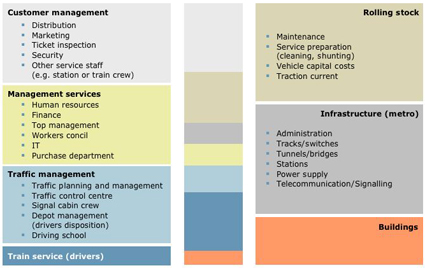

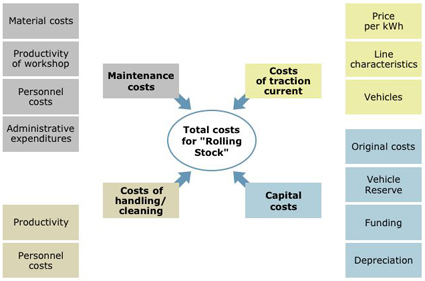

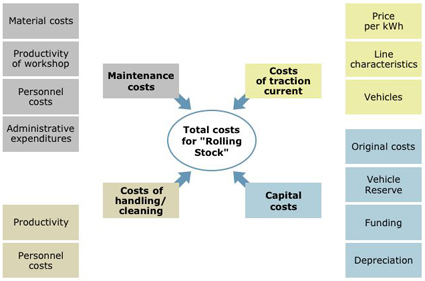

Regarding the cost benchmarking, a cost classification scheme is required that is independent of the respective organisational structures and cost accounting systems, in order to provide a realistic comparison of the participating companies. In the course of numerous projects with many of their clients, BSL Management Consultants have elaborated a unified, multi-layer cost structure that is based on the typical functions of the public transport production (Figure 2).

For the example of urban rail systems, the largest major functions on the top level are the infrastructure, rolling stock, management services, train service (drivers), traffic management and customer management. Subsequently, there is a second-level itemisation, e.g. in the case of the function rolling stock into the sub-functions of operative maintenance, vehicle preparation (shunting, cleaning etc.), vehicle capital costs and traction current (Figure 3).

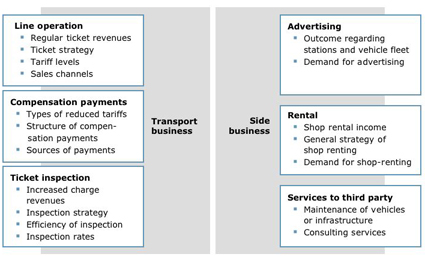

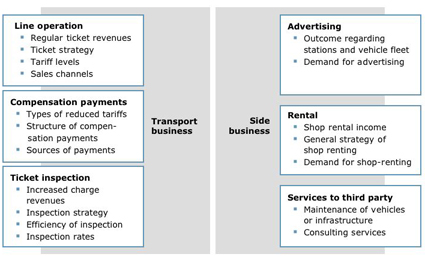

On the third analysis level, a further breakdown is carried out, providing for example the detailed components of the operative maintenance such as administration, warehouse, corrective and preventive maintenance, spare part reconditioning, retrofitting, etc. At this stage, a process-oriented benchmarking supplies statements about the effectiveness and efficiency of single processes. In order to find the causes for these detected effects, process analyses beyond the benchmarking are needed, but first hints are generally provided at this stage. A similar approach applies to the benchmarking of the company revenues (Figure 4).

The main sources of income are typically the transport business revenues such as regular ticket revenues from line operation, compensation payments for the granting of socially motivated reduced rates and ticket inspection. However, public transport companies can generate considerable income from side-business activities such as advertising, shop rental and services to third parties.

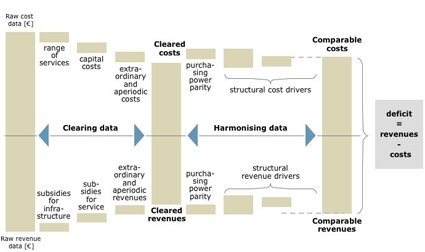

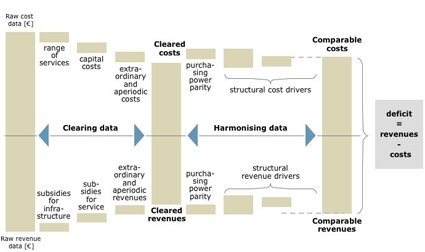

For establishing comparability, there is a clearing of the basic data at first, followed by the harmonisation of the structural circumstances and the range of services of the benchmarked companies (Figure 5).

In the treatment of the costs, the point of departure are the basic data of the compared urban rail systems on a rather aggregated level. First of all, the pure transportation (operator) costs and the infrastructure costs are separated since the infrastructure is a given, location-specific cost factor. Subsequently, the data needs to be corrected for extraordinary effects and costs that in fact belong to other accounting periods. At the same time, services for and from third parties are separated if necessary, leading to the intermediate result of the ‘cleared costs’. Subsequently, the structural cost drivers that are not changeable in the short-term are extracted, such as the circulation speed, fleet structure, vehicle age, kilometric performance, number of passengers, station density, switch density, types of tracks etc. Only after these non-controllable cost drivers are harmonised is a reliable basis for comparison is established.

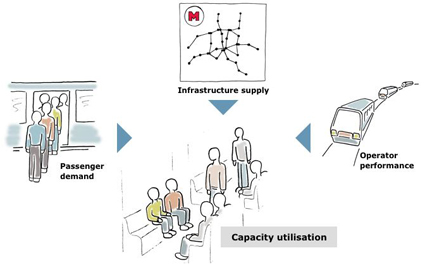

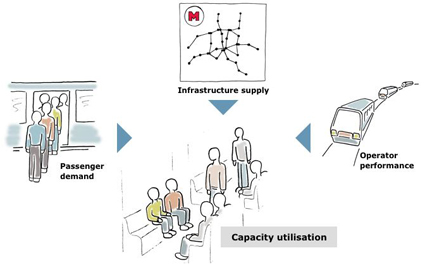

An integral part of the benchmarking, besides costs and revenues, is the analysis of the traffic supply and quality. The traffic supply benchmarking is based on three main aspects, the passenger demand, the infrastructure supply and the operator performance (Figure 6). A whole set of significant, colluding indicators characterises the traffic supply situation.

The quality benchmarking takes into account all relevant service aspects of the investigated public transport systems. The classification of the quality indicators is along the lines of DIN EN 13816, where several sub-categories belong to each of the principal quality (Figure 7). The quality indicators are graded by their importance for the customer.

The quantitative quality benchmarking mainly relies on direct performance measurements (DPM) which are supported qualitatively by also referring to customer satisfaction surveys (CSS) if available.

The information gathered within the described benchmarking of the individual performance aspects of the public transport company can finally be aggregated by determination of the transportation cost coverage and overall service quality. Basing this overall rating on the four aspects of costs, revenues, traffic supply and quality, the comprehensive benchmarking approach does justice to all participants and their different system philosophies.

A specific benchmarking example

The above general presentation of the benchmarking shall be illustrated with an instructive concrete example of the function ‘train service (drivers)’. The specific driver costs per train-kilometre are comparable only after they have been harmonised, adjusting the differences in circulation speed (Figure 8).

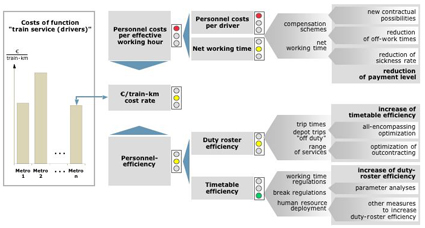

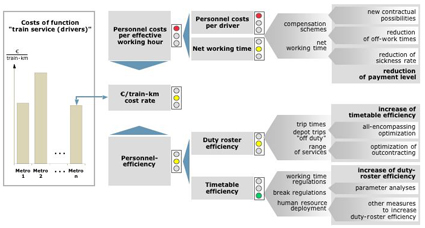

The influencing variables determining the cost level of the drivers function are the labour costs per driver, their net working time, the driver productivity and the efficiency of the timetable (Figure 9). The gaps in the cost rate between the benchmarked companies can hence be explained by investigating these indicators, which provides the management with the key issues to focus on for their respective company.

All functions within the benchmarking are treated analytically in a similar way, i.e. by breaking down the respective competitive position found by the benchmarking into the underlying cause variables.

From benchmark to action

The result of the integrated benchmarking is a comprehensive and detailed comparison that reveals the strong points and weaknesses of the participating companies in all regarded areas. In practice, a lot of companies take the chance of using this as a basis for elaborating tangible internal reorganisation strategies.

The fact that the analysis is broken down to the second and third level of detail in all functions and that productivity and performance indicators are calculated at the same time offers the opportunity to localise the respective starting points for improvements to a high level of accuracy and to process them to concrete recommendations for action (also using the experiences gained by other companies).

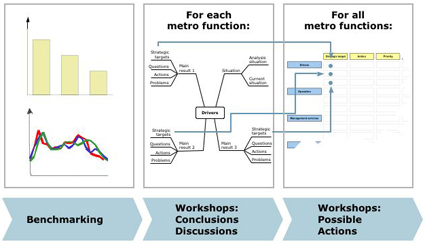

In specific cases, a very target-oriented, multi-level proceeding for the derivation of actions was arranged with the respective company management as continuation of the benchmarking. Figure 10 shows the individual steps in this way ‘from benchmark to action’ that included a whole series of workshops. For every company function, it was at first discussed with the top management which strategic conclusions had to be drawn from the results of the benchmarking. Based on this, strategic targets were defined and related questions and problems as well as first starting points for action were collected and attributed to the strategic targets. The result was a first overview of possible actions that subsequently needed to be refined.

For this purpose, dedicated workshops with the respective experts of the concerned departments were carried out. The crucial point was to integrate those employees in the discussion who were familiar with the details and particularities of the division’s daily operation, and to search together with them for ways of enabling the realisation of the strategic targets. Within these workshops, the lists of possible actions was intensely discussed and revised – many starting points for action were added, many were substantiated and other ideas were discarded in case they did not fit the special circumstances on-site.

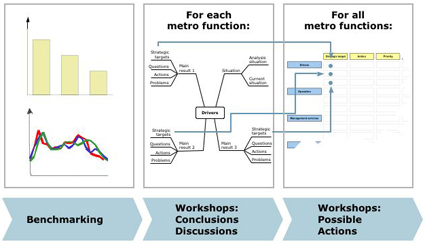

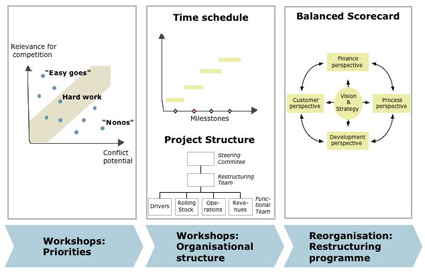

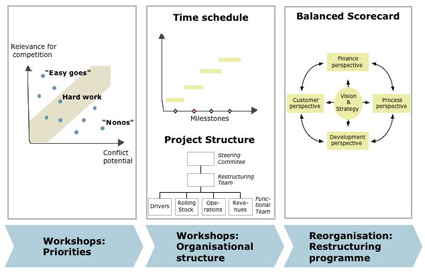

The action list resulting from the common discussion was complemented by adding the priority for each action in order to focus the short-term efforts to the crucial issues and improvement projects. For this purpose, all actions were assessed with respect to the following criteria:

- What is the relevance of the respective action for the competitiveness of the company?

- What is the conflict potential related to the implementation of the respective action?

By means of these criteria, the possible actions could be sorted by priorities. For further processing within the involved divisions, the deadlines for accomplishment and the responsibilities were assigned for each measure, finally leading to a clear roadmap.

Bottom line

The experiences gained in various projects with urban rail systems have shown that a qualified benchmarking still belongs to the most powerful management tools that help uncover possibilities of optimisation in the domain of public transport companies. The knowledge of the ‘big’ and ‘small’ differences between the different companies and the understanding of the reasons for different cost and revenue situations help the decision- makers to move the right lever for a coherent development of their undertakings.

The results that came out in the diverse sub-functions and topics showed considerable variation in such a way that even companies which had already carried out optimisation projects in many areas could be provided with starting points for action that directly entered the further in-house optimisation works.

The benchmarking experience of many years identifies quite clearly the success factors that determine the achievement of the project targets:

- A high level of confidence among all participants in order to facilitate an exchange of detailed company data without taboos.

- The willingness and open-mindedness of the involved employees of the companies to discuss new and potentially unconventional ideas.

- A sound and well-proven methodology which fulfils the requirements of a qualified benchmarking as described above.

- A professional support of the project works by a consultant particularly familiar with the peculiarities of the public-transport business. The latter includes detailed knowledge about the public-transport market and a database that is up-to-date in order to enrich the discussion with beneficial advice.

In various benchmarking circles, these prerequisites could be met and the targets of the project could hence be achieved. Furthermore, the participating companies generally managed to get used to the outlined approach and the corresponding data requirements quickly.

An advantage of the benchmarking approach is its universal applicability. Transport modes such as metro, bus etc. can be individually analysed, but also the entire public transport companies as a whole.

Figure 1: Components of the integrated benchmarking

Figure 2: Functional structure of the cost benchmarking

Figure 3: Sub-functions of the rolling-stock analysis

Figure 4: Classification of the revenue benchmarking

Figure 5: Methodology of clearing and harmonising the data

Figure 6: Main aspects of the transport offer analysis

Figure 7: The indicator system of the quality benchmarking

Figure 8: Harmonisation example for the function ‘train service (drivers)’

Figure 9: Cause variables of the performance in the function ‘train service (drivers)’

Figure 10: First steps ‘from benchmarking to action’

Figure 11: Final steps ’from benchmarking to action’

Issue

Issue 1 2005

Related modes

Trams